What Are The Respective Amounts In The Total Money Supply For The United States

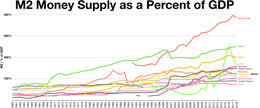

China M2 money supply vs USA M2 coin supply

In macroeconomics, the money supply (or money stock) refers to the total book of currency held by the public at a item point in time. In that location are several ways to define "coin", but standard measures usually include currency in circulation (i.e. physical cash) and demand deposits (depositors' easily accessed assets on the books of financial institutions).[1] [2] The central bank of a country may utilise a definition of what constitutes legal tender for its purposes.

Money supply data is recorded and published, usually by a government agency or the central bank of the country. Public and individual sector analysts monitor changes in the money supply considering of the belief that such changes affect the toll levels of securities, inflation, the substitution rates, and the business organisation cycle.[3]

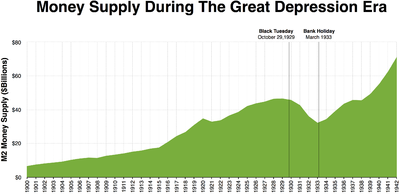

The human relationship betwixt money and prices has historically been associated with the quantity theory of money. There is some empirical evidence of a direct human relationship betwixt the growth of the coin supply and long-term price inflation, at to the lowest degree for rapid increases in the corporeality of coin in the economy.[iv] For example, a country such equally Republic of zimbabwe which saw extremely rapid increases in its money supply besides saw extremely rapid increases in prices (hyperinflation). This is one reason for the reliance on monetary policy as a means of controlling inflation.[5] [vi]

Coin creation by commercial banks [edit]

Commercial banks play a function in the procedure of coin creation, under the fractional-reserve banking organisation used throughout the world. In this system, credit is created whenever a bank gives out a new loan and destroyed when the borrower pays dorsum the principal on the loan.[seven]

This new coin, in net terms, makes up the non-M0 component in the M1-M3 statistics. In curt, at that place are two types of money in a fractional-reserve banking system:[viii] [ix] [10]

- central bank coin — obligations of a cardinal bank, including currency and primal bank depository accounts

- commercial bank money — obligations of commercial banks, including checking accounts and savings accounts.

In the coin supply statistics, central bank money is MB while the commercial banking concern money is divided up into the M1-M3 components. More often than not, the types of commercial bank money that tend to be valued at lower amounts are classified in the narrow category of M1 while the types of commercial bank money that tend to exist in larger amounts are categorized in M2 and M3, with M3 having the largest.

In the United States, a banking company's reserves consist of U.S. currency held by the depository financial institution (also known as "vault cash"[eleven]) plus the banking concern'southward balances in Federal Reserve accounts.[12] [13] For this purpose, greenbacks on mitt and balances in Federal Reserve ("Fed") accounts are interchangeable (both are obligations of the Fed). Reserves may come from any source, including the federal funds market, deposits past the public, and borrowing from the Fed itself.[14]

Open up market operations by central banks [edit]

Fundamental banks can influence the money supply past open up market operations. They can increment the coin supply by purchasing authorities securities, such as government bonds or treasury bills. This increases the liquidity in the cyberbanking system past converting the illiquid securities of commercial banks into liquid deposits at the primal bank. This also causes the price of such securities to rise due to the increased need, and interest rates to fall. These funds become available to commercial banks for lending, and by the multiplier effect from fractional-reserve cyberbanking, loans and bank deposits get upwardly past many times the initial injection of funds into the banking system.

In contrast, when the fundamental bank "tightens" the money supply, it sells securities on the open up market place, drawing liquid funds out of the banking organisation. The prices of such securities fall every bit supply is increased, and interest rates rise. This also has a multiplier result.

This kind of activity reduces or increases the supply of short term regime debt in the easily of banks and the non-bank public, besides lowering or raising interest rates. In parallel, it increases or reduces the supply of loanable funds (coin) and thereby the ability of private banks to issue new money through issuing debt.

The simple connection between monetary policy and monetary aggregates such as M1 and M2 changed in the 1970s as the reserve requirements on deposits started to autumn with the emergence of money funds, which crave no reserves. Now, reserve requirements apply just to "transactions deposits" – essentially checking accounts. The vast bulk of funding sources used by individual banks to create loans are non limited past depository financial institution reserves. Almost commercial and industrial loans are financed by issuing large denomination CDs. Money market deposits are largely used to lend to corporations who effect commercial paper. Consumer loans are besides made using savings deposits, which are non subject to reserve requirements. This ways that instead of the value of loans supplied responding passively to monetary policy, we frequently run across it rising and falling with the need for funds and the willingness of banks to lend.

Some economists contend that the money multiplier is a meaningless concept, because its relevance would require that the coin supply exist exogenous, i.e. determined by the monetary authorities via open up market operations. If central banks usually target the shortest-term interest rate (as their policy instrument) and so this leads to the money supply being endogenous.[xv]

| | This section needs to be updated. (March 2009) |

Neither commercial nor consumer loans are any longer limited by bank reserves. Nor are they directly linked proportional to reserves. Between 1995 and 2008, the value of consumer loans has steadily increased out of proportion to bank reserves. So, as office of the financial crunch, bank reserves rose dramatically every bit new loans shrank.

In recent years, some academic economists renowned for their piece of work on the implications of rational expectations have argued that open market operations are irrelevant. These include Robert Lucas Jr., Thomas Sargent, Neil Wallace, Finn E. Kydland, Edward C. Prescott and Scott Freeman. Keynesian economists signal to the ineffectiveness of open market operations in 2008 in the United States, when short-term interest rates went as low as they could become in nominal terms, then that no more monetary stimulus could occur. This nada bound problem has been called the liquidity trap or "pushing on a string" (the pusher being the central bank and the cord being the existent economy).

Empirical measures in the U.s. Federal Reserve System [edit]

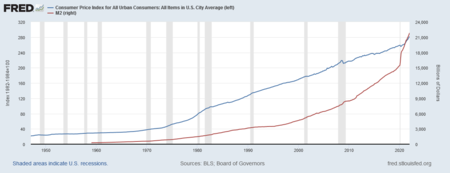

CPI-Urban (blue) vs M2 coin supply (scarlet); recessions in grey

- See also European Cardinal Bank for other approaches and a more than global perspective.

Money is used every bit a medium of exchange, as a unit of measurement of account, and as a ready shop of value. These different functions are associated with different empirical measures of the money supply. There is no unmarried "correct" measure out of the coin supply. Instead, at that place are several measures, classified along a spectrum or continuum between narrow and broad monetary aggregates. Narrow measures include but the most liquid assets: those virtually easily used to spend (currency, checkable deposits). Broader measures add less liquid types of assets (certificates of deposit, etc.).

This continuum corresponds to the fashion that dissimilar types of money are more or less controlled by monetary policy. Narrow measures include those more directly affected and controlled by monetary policy, whereas broader measures are less closely related to monetary-policy actions.[six] It is a affair of perennial argue as to whether narrower or broader versions of the money supply take a more predictable link to nominal Gross domestic product.

The different types of money are typically classified equally "Chiliad"south. The "K"s usually range from M0 (narrowest) to M3 (broadest) but which "1000"s are actually focused on in policy conception depends on the land's central banking concern. The typical layout for each of the "One thousand"s is every bit follows:

| Type of money | M0 | MB | M1 | M2 | M3 | MZM |

|---|---|---|---|---|---|---|

| Notes and coins in apportionment (outside Federal Reserve Banks and the vaults of depository institutions) (currency) | ✓[16] | ✓ | ✓ | ✓ | ✓ | ✓ |

| Notes and coins in bank vaults (vault cash) | ✓ | |||||

| Federal Reserve Banking company credit (required reserves and excess reserves not physically nowadays in banks) | ✓ | |||||

| Traveler's checks of not-bank issuers | ✓ | ✓ | ✓ | ✓ | ||

| Need deposits | ✓ | ✓ | ✓ | ✓ | ||

| Other checkable deposits (OCDs), which consist primarily of negotiable order of withdrawal (NOW) accounts at depository institutions and credit union share draft accounts. | ✓[17] | ✓ | ✓ | ✓ | ||

| Savings deposits | ✓[xviii] | ✓ | ✓ | ✓ | ||

| Time deposits less than $100,000 and money-market eolith accounts for individuals | ✓ | ✓ | ||||

| Big fourth dimension deposits, institutional money market place funds, curt-term repurchase and other larger liquid assets[xix] | ✓ | |||||

| All money market funds | ✓ |

- M0 : In some countries, such as the United kingdom, M0 includes depository financial institution reserves, so M0 is referred to as the budgetary base, or narrow money.[20]

- MB: is referred to as the monetary base or full currency.[xvi] This is the base from which other forms of money (similar checking deposits, listed below) are created and is traditionally the well-nigh liquid measure out of the money supply.[21]

- M1: Depository financial institution reserves are non included in M1.

- M2: Represents M1 and "close substitutes" for M1.[22] M2 is a broader classification of money than M1. M2 is a primal economic indicator used to forecast inflation.[23]

- M3: M2 plus big and long-term deposits. Since 2006, M3 is no longer published by the United states of america central bank.[24] However, there are still estimates produced past various private institutions.

- MZM: Money with naught maturity. It measures the supply of financial avails redeemable at par on demand. Velocity of MZM is historically a relatively accurate predictor of inflation.[25] [26] [27]

The ratio of a pair of these measures, nearly oftentimes M2 / M0, is called the money multiplier.

Definitions of "money" [edit]

East Asia [edit]

Hong Kong SAR, China [edit]

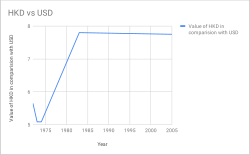

In 1967, when sterling was devalued, the Hong Kong dollar'due south peg to the pound was increased from 1 shilling 3 pence (£1 = HK$16) to one shilling 4½ pence (£1 = HK$14.5455) although this did not entirely showtime the devaluation of sterling relative to the US dollar (it went from U.s.$i = HK$5.71 to US$1 = HK$half-dozen.06). In 1972 the Hong Kong dollar was pegged to the U.s.a. dollar at a rate of US$1 = HK$five.65. This was reduced to HK$5.085 in 1973. Between 1974 and 1983 the Hong Kong dollar floated. On Oct 17, 1983, the currency was pegged at a rate of The states$ane = HK$7.80 through the currency board system.

As of May 18, 2005, in addition to the lower guaranteed limit, a new upper guaranteed limit was set up for the [Hong Kong dollar at 7.75 to the American dollar. The lower limit was lowered from 7.lxxx to 7.85 (by 100 pips per week from May 23 to June 20, 2005). The Hong Kong Budgetary Authority indicated that this motion was to narrow the gap between the interest rates in Hong Kong and those of the United States. A further aim of allowing the Hong Kong dollar to trade in a range is to avert the HK dollar being used equally a proxy for speculative bets on a renminbi revaluation.

The Hong Kong Basic Law and the Sino-British Joint Annunciation provides that Hong Kong retains full autonomy with respect to currency issuance. Currency in Hong Kong is issued by the government and iii local banks under the supervision of the territory'south de facto central depository financial institution, the Hong Kong Monetary Authority. Bank notes are printed by Hong Kong Note Printing.

A bank can issue a Hong Kong dollar but if information technology has the equivalent commutation in US dollars on eolith. The currency board organisation ensures that Hong Kong's entire monetary base is backed with US dollars at the linked substitution rate. The resources for the backing are kept in Hong Kong'due south exchange fund, which is among the largest official reserves in the world. Hong Kong also has huge deposits of United states dollars, with official foreign currency reserves of 331.3 billion USD as of September 2014[update].[28]

Nippon [edit]

Japanese money supply (Apr 1998 – April 2008)

The Bank of Nippon defines the monetary aggregates as:[29]

- M1: cash currency in apportionment, plus deposit money

- M2 + CDs: M1 plus quasi-money and CDs

- M3 + CDs: M2 + CDs plus deposits of postal service offices; other savings and deposits with financial institutions; and money trusts

- Broadly defined liquidity: M3 and CDs, plus money market place, pecuniary trusts other than money trusts, investment trusts, bank debentures, commercial paper issued by financial institutions, repurchase agreements and securities lending with cash collateral, government bonds and foreign bonds

Europe [edit]

United kingdom [edit]

In that location are just two official UK measures. M0 is referred to as the "broad monetary base" or "narrow money" and M4 is referred to every bit "broad coin" or just "the money supply".

- M0: Notes and coin in circulation plus banks' reserve balance with Banking concern of England. (When the banking company introduced Money Market Reform in May 2006, the banking company ceased publication of M0 and instead began publishing series for reserve balances at the Bank of England to back-trail notes and money in circulation.[30])

- M4: Greenbacks exterior banks (i.eastward. in circulation with the public and not-bank firms) plus individual-sector retail depository financial institution and building society deposits plus private-sector wholesale bank and building society deposits and certificates of deposit.[31] In 2010 the total money supply (M4) measure in the United kingdom was £2.two trillion while the actual notes and coins in circulation totalled only £47 billion, two.1% of the bodily money supply.[32]

There are several different definitions of money supply to reflect the differing stores of money. Attributable to the nature of bank deposits, especially time-restricted savings business relationship deposits, M4 represents the most illiquid measure of money. M0, by contrast, is the most liquid measure of the money supply.

Eurozone [edit]

The euro money supplies M0, M1, M2 and M3, and euro zone GDP from 1980–2021. Logarithmic scale.

The European Central Bank'southward definition of euro expanse monetary aggregates:[33]

- M1: Currency in apportionment plus overnight deposits

- M2: M1 plus deposits with an agreed maturity up to two years plus deposits redeemable at a flow of notice up to three months.

- M3: M2 plus repurchase agreements plus coin market fund (MMF) shares/units, plus debt securities up to two years

North America [edit]

United States [edit]

MB, M1 and M2 from 1959 to 2021 (all shown in billions) Link. Note that before April 24, 2020 savings accounts were not function of M1[34]

M0, M1 and M3. US-GDP and M3 of Eurozone for comparison. Logarithmic scale.

The United states of america Federal Reserve published information on three monetary aggregates until 2006, when it ceased publication of M3 information[24] and only published data on M1 and M2. M1 consists of money unremarkably used for payment, basically currency in circulation and checking account balances; and M2 includes M1 plus balances that generally are similar to transaction accounts and that, for the most part, tin be converted fairly readily to M1 with picayune or no loss of principal. The M2 measure is thought to be held primarily past households. Prior to its discontinuation, M3 comprised M2 plus certain accounts that are held by entities other than individuals and are issued by banks and thrift institutions to augment M2-blazon balances in meeting credit demands, equally well as balances in money marketplace mutual funds held by institutional investors. The aggregates have had different roles in monetary policy every bit their reliability equally guides has inverse. The principal components are:[35]

- M0: The full of all concrete currency including coinage. M0 = Federal Reserve Notes + Usa Notes + Coins. It is non relevant whether the currency is held within or outside of the private banking system as reserves.

- MB: The total of all physical currency plus Federal Reserve Deposits (special deposits that merely banks can have at the Fed). MB = Coins + U.s. Notes + Federal Reserve Notes + Federal Reserve Deposits

- M1: The total amount of M0 (cash/money) outside of the private banking system[ clarification needed ] plus the amount of demand deposits, travelers checks and other checkable deposits + nearly savings accounts.

- M2: M1 + money marketplace accounts, retail money market place mutual funds, and minor denomination time deposits (certificates of deposit of under $100,000).

- MZM: 'Money Naught Maturity' is one of the virtually popular aggregates in utilize by the Fed considering its velocity has historically been the most authentic predictor of inflation. It is M2 – time deposits + coin market funds

- M3: M2 + all other CDs (big fourth dimension deposits, institutional money market mutual fund balances), deposits of eurodollars and repurchase agreements.

- M4-: M3 + Commercial Paper

- M4: M4- + T-Bills (or M3 + Commercial Paper + T-Bills)

- 50: The broadest measure out of liquidity, that the Federal Reserve no longer tracks. L is very close to M4 + Bankers' Acceptance

- Coin Multiplier: M1 / MB. Equally of Dec 3, 2015, it was 0.756.[36] While a multiplier under i is historically an oddity, this is a reflection of the popularity of M2 over M1 and the massive corporeality of MB the government has created since 2008.

Prior to 2020, savings accounts were counted as M2 and not part of M1 equally they were not considered "transaction accounts" by the Fed. (There was a limit of half dozen transactions per cycle that could be carried out in a savings account without incurring a punishment.) On March xv, 2020, the Federal Reserve eliminated reserve requirements for all depository institutions and rendered the regulatory stardom betwixt reservable "transaction accounts" and nonreservable "savings deposits" unnecessary. On April 24, 2020, the Board removed this regulatory stardom by deleting the six-per-month transfer limit on savings deposits. From this point on, savings account deposits were included in M1.[18]

Although the Treasury can and does hold cash and a special deposit account at the Fed (TGA account), these avails practice not count in any of the aggregates. So in essence, money paid in taxes paid to the Federal Government (Treasury) is excluded from the money supply. To counter this, the government created the Treasury Tax and Loan (TT&L) plan in which any receipts above a certain threshold are redeposited in individual banks. The idea is that tax receipts won't decrease the amount of reserves in the banking system. The TT&L accounts, while demand deposits, practice non count toward M1 or any other aggregate either.

When the Federal Reserve announced in 2005 that they would terminate publishing M3 statistics in March 2006, they explained that M3 did not convey any boosted information almost economic activity compared to M2, and thus, "has not played a role in the monetary policy process for many years." Therefore, the costs to collect M3 data outweighed the benefits the data provided.[24] Some politicians have spoken out against the Federal Reserve's determination to end publishing M3 statistics and take urged the U.South. Congress to accept steps requiring the Federal Reserve to do so. Congressman Ron Paul (R-TX) claimed that "M3 is the best description of how quickly the Fed is creating new money and credit. Common sense tells u.s. that a authorities primal bank creating new money out of thin air depreciates the value of each dollar in circulation."[37] Modernistic Monetary Theory disagrees. Information technology holds that money cosmos in a free-floating fiat currency government such every bit the U.Due south. will not lead to significant inflation unless the economic system is approaching total employment and full capacity. Some of the data used to summate M3 are still collected and published on a regular basis.[24] Current alternate sources of M3 data are bachelor from the private sector.[38]

Equally of April 2013, the monetary base was $three trillion[39] and M2, the broadest measure of money supply, was $10.5 trillion.[40]

Oceania [edit]

Australia [edit]

The coin supply of Australia 1984–2016

The Reserve Bank of Commonwealth of australia defines the budgetary aggregates as:[41]

- M1: currency in circulation plus bank current deposits from the private not-depository financial institution sector

- M3: M1 plus all other bank deposits from the private non-bank sector, plus bank certificate of deposits, less inter-bank deposits

- Broad coin: M3 plus borrowings from the private sector by NBFIs, less the latter'south holdings of currency and banking company deposits

- Money base: holdings of notes and coins by the private sector plus deposits of banks with the Reserve Bank of Australia (RBA) and other RBA liabilities to the private non-bank sector.

New Zealand [edit]

The Reserve Banking company of New Zealand defines the monetary aggregates as:[42]

- M1: notes and coins held by the public plus chequeable deposits, minus inter-institutional chequeable deposits, and minus central regime deposits

- M2: M1 + all non-M1 call funding (phone call funding includes overnight money and funding on terms that can of correct be cleaved without break penalties) minus inter-institutional non-M1 call funding

- M3: the broadest monetary aggregate. It represents all New Zealand dollar funding of M3 institutions and whatsoever Reserve Bank repos with not-M3 institutions. M3 consists of notes & money held by the public plus NZ dollar funding minus inter-M3 institutional claims and minus cardinal government deposits

South Asia [edit]

India [edit]

Components of the money supply of India in billions of Rupee for 1950–2011

The Reserve Bank of India defines the budgetary aggregates as:[43]

- Reserve money (M0): Currency in circulation, plus bankers' deposits with the RBI and 'other' deposits with the RBI. Calculated from net RBI credit to the government plus RBI credit to the commercial sector, plus RBI's claims on banks and internet foreign avails plus the regime's currency liabilities to the public, less the RBI'due south net non-monetary liabilities. M0 outstanding was ₹30.297 trillion equally on March 31, 2020.

- M1: Currency with the public plus deposit money of the public (demand deposits with the banking system and 'other' deposits with the RBI). M1 was 184 per cent of M0 in Baronial 2017.

- M2: M1 plus savings deposits with post office savings banks. M2 was 879 per cent of M0 in Baronial 2017.

- M3 (the broad concept of money supply): M1 plus fourth dimension deposits with the banking system, fabricated upwardly of net banking company credit to the government plus banking company credit to the commercial sector, plus the net strange exchange assets of the banking sector and the government's currency liabilities to the public, less the net non-monetary liabilities of the cyberbanking sector (other than fourth dimension deposits). M3 was 555 per cent of M0 equally on March 31, 2020(i.e. ₹167.99 trillion.)

- M4: M3 plus all deposits with mail service office savings banks (excluding National Savings Certificates).

[44]

Link with aggrandizement [edit]

Budgetary exchange equation [edit]

The money supply is important because it is linked to aggrandizement by the equation of exchange in an equation proposed by Irving Fisher in 1911:[45]

where

In mathematical terms, this equation is an identity which is true by definition rather than describing economical behavior. That is, velocity is defined by the values of the other three variables. Dissimilar the other terms, the velocity of coin has no independent mensurate and can only be estimated by dividing PQ by One thousand. Some adherents of the quantity theory of money presume that the velocity of coin is stable and predictable, being adamant generally by financial institutions. If that assumption is valid and then changes in M can be used to predict changes in PQ. If non, then a model of V is required in order for the equation of exchange to be useful every bit a macroeconomics model or as a predictor of prices.

Nearly macroeconomists replace the equation of commutation with equations for the demand for money which describe more regular and predictable economic behavior. Even so, predictability (or the lack thereof) of the velocity of coin is equivalent to predictability (or the lack thereof) of the need for money (since in equilibrium existent money need is simply Q / 5 ). Either way, this unpredictability made policy-makers at the Federal Reserve rely less on the money supply in steering the U.S. economy. Instead, the policy focus has shifted to interest rates such as the fed funds charge per unit.

In practice, macroeconomists almost always utilize existent GDP to ascertain Q, omitting the office of all transactions except for those involving newly produced goods and services (i.e., consumption goods, investment goods, government-purchased appurtenances, and exports). But the original quantity theory of money did non follow this practise: PQ was the monetary value of all new transactions, whether of real goods and services or of newspaper assets.

The monetary value of assets, goods, and services sold during the year could be grossly estimated using nominal Gdp dorsum in the 1960s. This is not the instance anymore considering of the dramatic ascent of the number of financial transactions relative to that of real transactions up until 2008. That is, the total value of transactions (including purchases of paper assets) rose relative to nominal GDP (which excludes those purchases).

Ignoring the effects of monetary growth on existent purchases and velocity, this suggests that the growth of the coin supply may cause different kinds of inflation at unlike times. For case, rises in the U.Southward. money supplies between the 1970s and the present encouraged first a rise in the inflation rate for newly-produced goods and services ("inflation" every bit unremarkably defined) in the 1970s so asset-cost inflation in later decades: it may have encouraged a stock market smash in the 1980s and 1990s and so, later on 2001, a rise in abode prices, i.e., the famous housing bubble. This story, of course, assumes that the amounts of coin were the causes of these dissimilar types of aggrandizement rather than being endogenous results of the economy's dynamics.

When domicile prices went down, the Federal Reserve kept its loose budgetary policy and lowered interest rates; the attempt to tiresome price declines in 1 nugget class, e.chiliad. real estate, may well accept caused prices in other asset classes to ascent, e.g. commodities.[ citation needed ]

Rates of growth [edit]

In terms of per centum changes (to a shut approximation, under low growth rates),[46] the percentage change in a product, say XY, is equal to the sum of the percentage changes %ΔX + %ΔY ). Then, cogent all per centum changes equally per unit of fourth dimension,

- %ΔP + %ΔQ = %ΔM + %ΔV

This equation rearranged gives the basic inflation identity:

- %ΔP = %Δ1000 + %Δ5 – %ΔQ

Inflation (%ΔP) is equal to the charge per unit of money growth (%ΔG), plus the alter in velocity (%ΔV), minus the rate of output growth (%ΔQ).[47] So if in the long run the growth charge per unit of velocity and the growth rate of real Gdp are exogenous constants (the former existence dictated by changes in payment institutions and the latter dictated by the growth in the economic system's productive capacity), then the monetary growth rate and the inflation charge per unit differ from each other by a fixed constant.

Equally before, this equation is merely useful if %ΔV follows regular beliefs. It too loses usefulness if the central bank lacks command over %ΔK.

Arguments [edit]

Historically, in Europe, the primary function of the cardinal banking company is to maintain low aggrandizement. In the The states the focus is on both aggrandizement and unemployment.[ commendation needed ] These goals are sometimes in conflict (co-ordinate to the Phillips curve). A primal depository financial institution may attempt to exercise this[ clarification needed ] by artificially influencing the demand for goods by increasing or decreasing the nation'southward coin supply (relative to tendency), which lowers or raises interest rates, which stimulates or restrains spending on appurtenances and services.

An important argue among economists in the second half of the 20th century concerned the central banking concern'southward power to predict how much money should exist in circulation, given current employment rates and inflation rates. Economists such as Milton Friedman believed that the central banking concern would e'er get it wrong, leading to wider swings in the economic system than if it were just left solitary.[48] This is why they advocated a non-interventionist arroyo: i of targeting a pre-specified path for the money supply contained of current economic weather, fifty-fifty though in practice this might involve regular intervention with open up market operations (or other monetary-policy tools) to keep the money supply on target.

The former Chairman of the U.s.a. Federal Reserve, Ben Bernanke, suggested in 2004 that over the preceding 10 to 15 years, many mod central banks became relatively good at manipulation of the coin supply, leading to a smoother business cycle, with recessions tending to exist smaller and less frequent than in before decades, a miracle termed "The Great Moderation"[49] This theory encountered criticism during the global financial crunch of 2008–2009.[ commendation needed ] Furthermore, information technology may be that the functions of the primal banking concern need to embrace more than the shifting up or down of interest rates or bank reserves:[ citation needed ] these tools, although valuable, may not in fact moderate the volatility of coin supply (or its velocity).[ citation needed ]

Bear upon of digital currencies and possible transition to a cashless society [edit]

Run into also [edit]

- A Program for Monetary Reform

- American Monetary Plant

- Banking company regulation

- Capital requirement

- Primal depository financial institution

- Chartalism

- Chicago program

- The Chicago Programme Revisited

- Committee on Monetary and Economic Reform

- Core aggrandizement

- Debt levels and flows

- Economics terminology that differs from common usage

- Fiat currency

- Financial upper-case letter

- Float

- Partial-reserve banking

- FRED (Federal Reserve Economic Data)

- Full reserve cyberbanking

- Neat Contraction

- Alphabetize of Leading Indicators – money supply is a component

- Inflation

- Monetarism

- Budgetary base

- Monetary economic science

- Monetary reform

- Money circulation

- Money creation

- Money market place

- Coin demand

- Liquidity preference

- Seigniorage

- Stagflation

References [edit]

- ^ Alan Deardorff. "Coin supply," Deardorff'south Glossary of International Economic science

- ^ Karl Brunner, "money supply," The New Palgrave: A Dictionary of Economics, 5. 3, p. 527.

- ^ The Money Supply – Federal Reserve Banking company of New York. Newyorkfed.org.

- ^ Sysoyeva, Larysa; Bielova, Inna; Ryabushka, Luidmila; Demikhov, Oleksii (May 29, 2021). "Determinants of Direction of Central Banking concern to Provide the Economical Growth: an Application of Structural Equation Modeling". Studies of Applied Economics. 39 (5). doi:10.25115/eea.v39i5.4803. ISSN 1697-5731. S2CID 236417850.

- ^ Milton Friedman (1987). "quantity theory of money", The New Palgrave: A Lexicon of Economics, 5. four, pp. 15–19.

- ^ a b "money supply Definition". Retrieved July 20, 2008.

- ^ McLeay, Michael. "Money Cosmos in the Modern Economy" (PDF). Bank of England.

- ^ "The coexistence of central and commercial bank monies: multiple issuers, one currency". The Role of Primal Banking concern Money in Payment Systems (PDF). Depository financial institution for International Settlements. p. 9.

- ^ The Role of Central Bank Coin in Payment Systems (PDF). Bank for International Settlements. p. 3.

Contemporary monetary systems are based on the mutually reinforcing roles of fundamental banking company coin and commercial banking concern monies.

- ^ Domestic payments in Euroland: commercial and central bank coin. European Fundamental Bank. November 9, 2000.

At the beginning of the 20th almost the totality of retail payments were made in central banking concern money. Over time, this monopoly came to be shared with commercial banks, when deposits and their transfer via checks and giros became widely accepted. Banknotes and commercial banking company money became fully interchangeable payment media that customers could employ according to their needs. While transaction costs in commercial depository financial institution money were shrinking, cashless payment instruments became increasingly used, at the expense of banknotes.

- ^ 12 C.F.R. sec. 204.2(g).

- ^ 12 C.F.R. sec. 204.five(a).

- ^ What is vault greenbacks? definition and significant. Investorwords.com.

- ^ "Net Free or Borrowed Reserves of Depository Institutions (NFORBRES) – FRED". research.stlouisfed.org. St. Louis Fed. January 1929. .

- ^ Boermans, Martijn; Moore, Basil (2009). Locked-in and Gummy textbooks. Issuu.com.

- ^ a b "Golden, Oil, Stocks, Investments, Currencies, and the Federal Reserve: Growth of Global Money Supply" Archived September 15, 2015, at the Wayback Machine. DollarDaze Economic Commentary Blog past Mike Hewitt.

- ^ M1 Money Stock (M1) – FRED – St. Louis Fed. Research.stlouisfed.org.

- ^ a b "Revisions to the H.half dozen Statistical Release". Dec 17, 2020.

{{cite web}}: CS1 maint: url-status (link) - ^ M3 Definition. Investopedia (February 15, 2009).

- ^ M0 (monetary base). Moneyterms.co.britain.

- ^ "M0". Investopedia. Archived from the original on March 30, 2018. Retrieved July 20, 2008.

- ^ "M2". Investopedia. Retrieved July 20, 2008.

- ^ "M2 Definition". InvestorWords.com. Archived from the original on July 13, 2008. Retrieved July twenty, 2008.

- ^ a b c d Discontinuance of M3, Federal Reserve, November 10, 2005, revised March 9, 2006.

- ^ Aziz, John (March 10, 2013). "Is Inflation E'er And Everywhere a Budgetary Miracle?". Azizonomics . Retrieved April two, 2013.

- ^ Thayer, Gary (January xvi, 2013). "Investors should assume that aggrandizement will exceed the Fed'southward target". Macro Strategy. Wells Fargo Advisors. Archived from the original on July fourteen, 2014. Retrieved April 2, 2013.

- ^ Carlson, John B.; Benjamin D. Keen (1996). "MZM: A monetary aggregate for the 1990s?" (PDF). Economical Review. Federal Reserve Bank of Cleveland. 32 (2): fifteen–23. Archived from the original (PDF) on September 4, 2012. Retrieved April 2, 2013.

- ^ "Hong Kong's Latest Foreign Currency Reserve Assets Figures Released". Hong Kong Monetary Authorisation. Retrieved Nov 20, 2016.

- ^ (PDF). Bank of Japan. p. xi http://world wide web.boj.or.jp/en/type/exp/stat/data/exms01.pdf.

- ^ "Further details well-nigh M0 data". Bank of England. November 8, 2018.

- ^ "Explanatory Notes – M4". Bank of England. Archived from the original on August 9, 2007. Retrieved Baronial 13, 2007.

- ^ Lipsey, Richard One thousand.; Chrystal, K. Alec (2011). Economic science (12th ed.). Oxford University Press. p. 455. ISBN978-0199563388.

- ^ "Budgetary aggregates". European Central Banking company. Retrieved Nov 20, 2016.

- ^ "Savings are now more liquid and part of "M1 money"". St. Louis Federal Reserve Bank.

- ^ "The Federal Reserve – Purposes and Functions" . Federalreserve.gov. April 24, 2013. Retrieved Dec xi, 2013.

- ^ "M1 Money Multiplier". research.stlouisfed.org. Feb 15, 1984. Retrieved December iii, 2015.

- ^ What the Price of Gold Is Telling United states of america. Lewrockwell.com (April 25, 2006).

- ^ "Alternating data". Shadowstats.com.

- ^ "Aggregate Reserves of Depository Institutions and the Monetary Base – H.three". Federal Reserve. Archived from the original on June 16, 2013.

- ^ "H.half-dozen Money Stock Measures". Federal Reserve Statistical Release. Federal Reserve. Archived from the original on June sixteen, 2013.

- ^ "Glossary". Reserve Bank of Australia. November 11, 2015.

- ^ Series description – Monetary and financial statistics. Rbnz.govt.nz.

- ^ "Notes on Tables". Handbook of Statistics on Indian Economic system (PDF). p. 4.

- ^ "Press Releases of Reserve Bank of Bharat on 16 Dec 2020".

- ^ The Purchasing Power of Money, its Decision and Relation to Credit, Involvement and Crises, Irving Fisher.

- ^ "Percentage Change Approximation". Archived from the original on July 24, 2012.

- ^ "Breaking Budgetary Policy into Pieces". May 24, 2004.

- ^ Milton Friedman (1962). Commercialism and Freedom . [Chicago] Academy of Chicago Press.

- ^ Speech, Bernanke – The Great Moderation. Federal Reserve Banking concern (February 20, 2004).

Further reading [edit]

- Article in the New Palgrave on Money Supply by Milton Friedman

- Practise all banks agree reserves, and, if and then, where do they hold them? (11/2001)

- What effect does a change in the reserve requirement accept on the money supply? (08/2001)

- St. Louis Fed: Monetary Aggregates

- Hülsmann, Jörg (2008). The Ethics of Coin Product. Auburn, Alabama: Ludwig von Mises Constitute. p. 294. ISBN9781933550091.

- Discontinuance of M3 Publication

- Investopedia: Money Zero Maturity (MZM)

External links [edit]

- Aggregate Reserves Of Depository Institutions And The Budgetary Base (H.3)

- Historical H.3 releases

- Money Stock Measures (H.6)

- U.Due south. MZM magnitude and velocity, used equally a predictor of aggrandizement

- Data on Monetary Aggregates in Australia

- Monetary Statistics on Hong Kong Budgetary Authority

- Monetary Survey from People's Bank of Cathay

Source: https://en.wikipedia.org/wiki/Money_supply

Posted by: weesnerforgand57.blogspot.com

0 Response to "What Are The Respective Amounts In The Total Money Supply For The United States"

Post a Comment